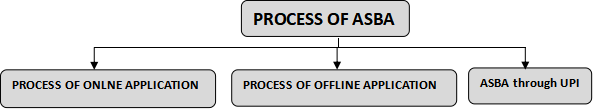

1).Online Application form Of ASBA: - - Log in to your Net banking account and click on ‘IPO Application’.

- Select the specific IPO you wish to invest in and choose up to 3 bids.

- Fill in the application form with the necessary details in the redirected IPO platform.

- Fill in details such as PAN number, bid price, bid quantity, and 16 digit DP number.

- Place and confirm your order.

- After you submit your application successfully, you can check the status on NSE and BSE websites.

2).Offline Application Process: - - Download the application form available from NSE and BSE websites.

- Fill out the details such as name, PAN details, bid price, bid quantity, Demat account number, bank account number and IFSC.

- Submit the duly filled application form at the Self-certified Syndicate Bank.

- Collect the receipt.

- The bank will block the amount and upload the details on the bidding platform.

3).ASBA Through UPI :-

|