CONCEPT OF UPI: - - UPI is short of Unified Payment Interface. UPI is a platform build by the National Payments Corporation of India (NPCI) to simplify retail payments and settlement systems in India. It is an initiative by RBI and the Indian Banks Association (IBA).

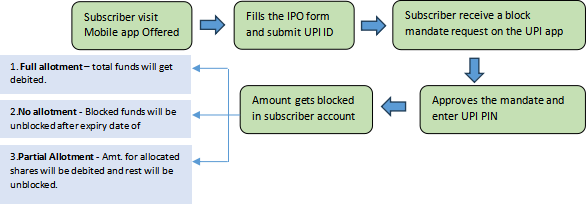

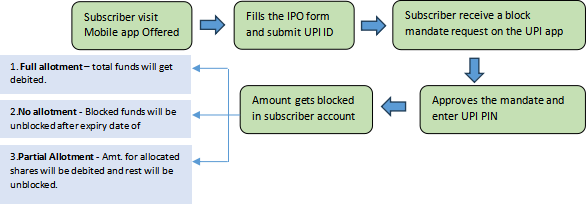

- The UPI IPO application allows you to apply in an IPO directly from your broker (i.e., Jainam, Zerodha, sharekhan etc.) It requires an additional step of approving the fund block mandate request in BHIM or net-banking mobile app.

PROCESS OF UPI IPO APPLICATION:

- Create a UPI ID using the net banking app.

- Visit the IPO website or Mobile App offered by your broker.

- Select the IPO and click the Apply button.

- Fill the form and submit the UPI ID as a payment option.

- The broker sends the IPO application to the exchange.

- You will receive a block mandate request on your UPI App (Net-banking or BHIM). This may take up to 24 hrs.

- Login to net-banking or BHIM and approve the mandate request.

- The funds get blocked in your bank account.

- Exchange sends application data to the registrar after the issue closes.

- Registrar allocates the shares.

- Funds are withdrawn or unblocked from the bank account.

- Registrar transfers the shares to your demat account.

|