- The Dividend amount received may be lesser than expected due to application of (TDS)Tax Deducted at Source on Dividends declared on equity shares and mutual funds.

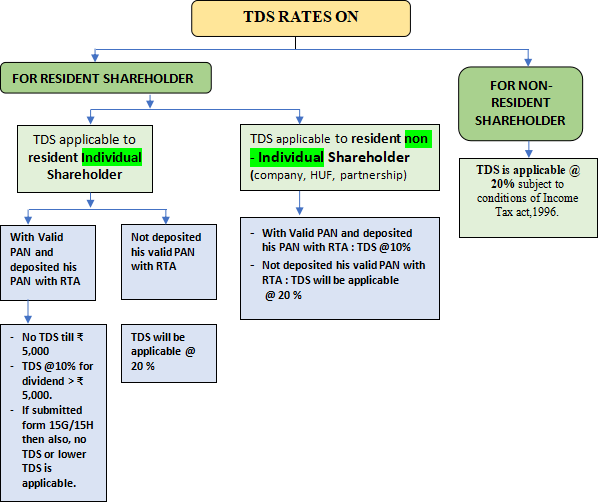

- TDS Rate On Dividends:

The different rates of TDS in different scenarios are as below given information: - - TDS rates for the individuals are as given below : -

- For resident individual who have submitted their valid PAN with RTA :

- There will be no TDS if the dividend amount is up to ₹ 5,000.

- TDS at the rate of 10% will be applicable if dividend is greater than ₹ 5,000.

- If form 15G or 15H is filed with the RTA of the company issuing dividends, TDS is deducted at a lower/NIL rate.

- For resident individual who have not submitted their valid PAN with RTA :

- TDS of 20% will be applicable If the registrar (RTA) of the company doesn't have the PAN details of the investor in its records.

- TDS rates for the non – individuals (as company, partnership firm) are as given below

- If valid PAN is deposited with RTA : TDS @10% on the entire dividend income.

- If valid PAN is not deposited with RTA : TDS will be applicable @ 20 % on the entire dividend income.

- TDS of 20% will be applicable for all non-resident shareholders.

|